- A technical and commercial overview of technology being deployed in this area.

- An overview of existing and new developing markets based on SSLNG.

- Technical and commercial assessment of potential SSLNG projects.

- Modelling of complex logistics associated with delivering SSLNG to customers via truck, train or marine vessel.

Case Studies

Background

The energy sector within South Africa faces a number of challenges as follows:

- A growing supply/demand deficit.

- Capacity constraints for pipelines supplying industrial consumers.

- The need to prioritise constrained gas supplies amongst different provinces.

In the light of the above, IFC, in collaboration with its Client in South Africa asked MJMEnergy to firstly provide technical and commercial support regarding the viability of an FSRU LNG import terminal on South Africa’s East coast; And secondly, to undertake an assessment of potential gas demand resulting from both the enhancement of existing gas network infrastructure and the development of a new virtual pipeline network to serve off-grid customers using SSLNG technology. The focus of this project brief is on the latter.

Brief overview of the project

In particular MJMEnergy focused on the following areas in relation to SSLNG:

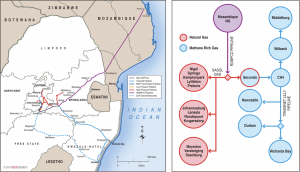

The demand analysis – The role of the Project Team initially involved a review of previous work, followed by a detailed analysis of potential gas demand via the existing gas network infrastructure (shown below) and via a potential virtual pipeline network.

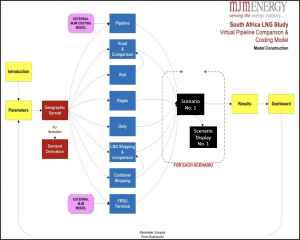

The operation and cost of the virtual pipeline network – In addition to assessing the potential demand via existing gas network infrastructure the Project Team also developed a market based nodal model that analysed the potential demand and associated costs for supplying gas to customers via a network of virtual pipelines. The model enabled the Project Team to optimise the cost of transporting LNG using both ISO containers by road, rail and ship as well via bespoke SSLNG tankers and rail trucks. The following schematic is an example of one of the scenarios modelled.

Key conclusions in relation to this work –The Project Team were able to conclude the following in relation to South Africa.

- Additional supplies of natural gas will be required as soon as possible.

- The gas market is growing and will continue to grow subject to availability.

- Existing pipeline assets can be enhanced to deliver gas to the growing gas market.

- A virtual pipeline network can deliver LNG to off-grid customers economically.

Project implementation

In order to undertake this work for MJMEnergy formed a bespoke Project Team made up from a combination of MJMEnergy internal staff, international associates and local partners in South Africa.

Background

The Republic of Senegal is in the process of developing significant offshore hydrocarbon discoveries that should result in both LNG exports and the delivery of pipeline gas to Senegal’s domestic gas market. However, whilst the exact timescale for offshore gas development and production is not yet certain, the expectation is that gas could begin to flow as early as 2021, or as late as 2025.

Brief overview of the project

Therefore, the purpose of this assignment was to undertake a process of high-level thinking in relation to the rules and regulatory structures that might underpin an ‘LNG bridge’ in order to facilitate the development of an open and competitive gas market in Senegal. MJMEnergy therefore focussed on the following three areas:

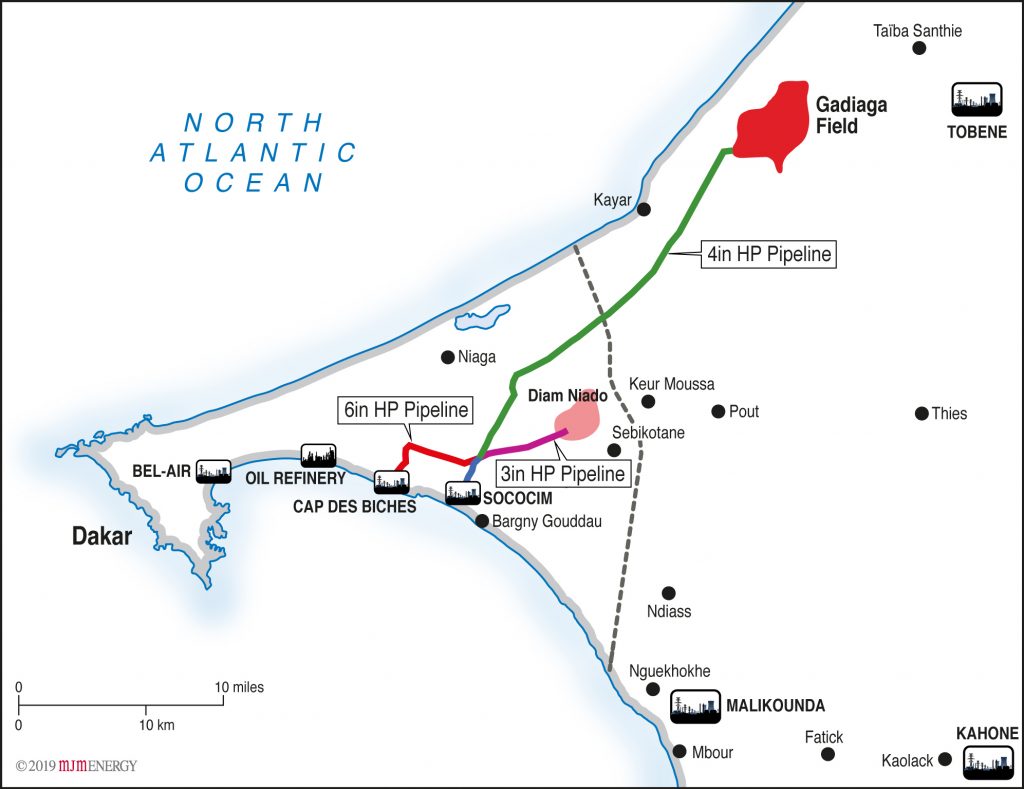

- Gas supply and network context – Analysis of the configuration and cost of midstream infrastructure focussing on the development of the gas pipeline network

- Midstream Pipeline Network Analysis – Examination of how the gas pipeline network in Senegal might develop based on certain key assumptions and costs

- Midstream small-scale LNG (SSLNG) analysis – Analysis of the potential designs and estimated costs of developing an SSLNG liquefaction plant in northern Senegal.

Gas supply and network context – The Project Team provided background and context to the way that upstream gas supplies, mid-stream gas network infrastructure and downstream gas markets might develop in Senegal. This included:

- Schematic overview of three main gas supply options with a brief commentary

- Detailed discussion of the different gas supply options for Senegal.

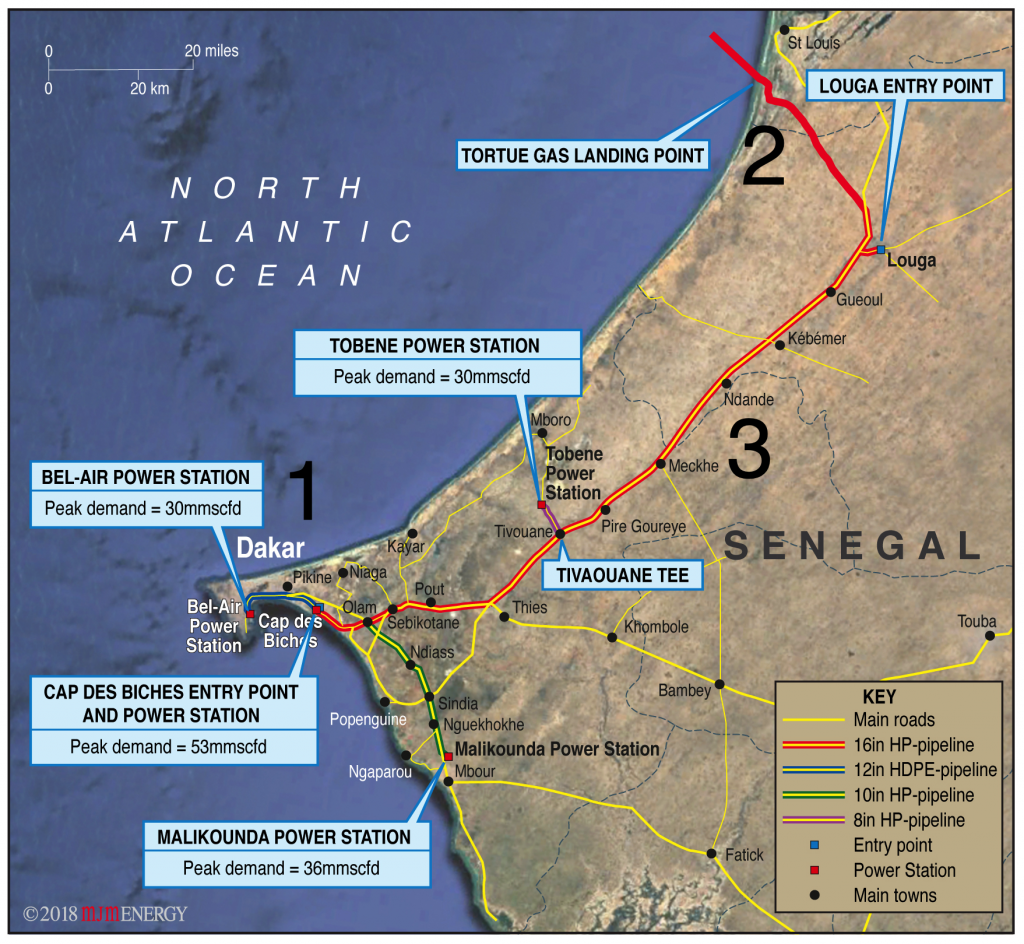

- Discussion of potential infrastructure development stages (image below)

- Stage 1 – Network develops from Dakar in the south

- Stage 2 – Network develops from Tortue in the north

- Stage 3 – Northern and Southern gas pipeline networks connect

Midstream Pipeline Network Analysis – MJMEnergy provided:

- Key assumptions used in relation to the development of the gas pipeline network

- Pipeline maps & schematics – potential network options for Senegal

- A summary of the gas pipeline development costs

- Discussion of the key issues associated with developing a gas pipeline network for Senegal.

Midstream small-scale LNG (SSLNG) analysis – One of the options being considered for the gas market in Senegal is the development of an SSLNG liquefaction plant in northern Senegal, which would provide Senegal with the ability to move LNG to consumers in the absence of an integrated gas pipeline network. Therefore, the Project Team:

- Highlighted the assumptions made in terms of the quantity and quality of the potential gas supply from Tortue, the operational characteristics of the LNG road tankers, and nature of the market being supplied

- Considered a number of different design options for the SSLNG plant

- Provided a summary of the SSLNG development costs

- Discussion of key issues associated with developing an SSLNG plant in Senegal

Key Conclusions

- Initial volumes from offshore fields will be insufficient to meet the needs of the developing power generation market and but could supply power generation and an SSLNG plant.

- The LNG-Bridge is the best option for early gas supplies

- Whilst the actual timing of gas deliveries to Senegal is unclear, the pipeline network should be developed and sized in such a way that the developing gas demand could be supplied from both the north and the south.

Background

Despite being discovered in 1974, the various owners and developers of the Kudu gas field have struggled to monetise the Kudu development. This is due to a variety of reasons including the absence of a sufficiently large anchor load to underwrite the project. Over the years various options have been considered, including developing a large power station on the coast and transmitting power to both Namibia and South Africa, or building a smaller power station and transporting gas to power stations in South Africa. However, the economics of this region are particularly challenging due to the low population densities, huge distances between population centres and a lack of gas and power infrastructure.

The current plans for the development of the Kudu gas field face similar challenges, since under the current proposal only 62 mmcfd of the output from the Kudu development will be consumed by ‘an anchor load’ power plant, which will not be sufficient to provide a robust economic underpinning of the project. Therefore, in order to strengthen the economics of the Kudu development, reliable additional gas loads need to be found. In addition, the opportunity to substitute HFO and diesel with natural gas in Namibia and the surrounding region could provide both economic and environmental benefits.

One option for Namibia being considered by IFC, which provided the main background for this Project, was the development of an SSLNG downstream gas market supplied with LNG via small scale liquefaction plant supplied with feedstock gas from the Kudu development.

Overview of the Project

MJMEnergy undertook a study investigating the potential market for gas (in the form of SSLNG) in Namibia, the Western Cape and other bordering countries. Additionally, MJMEnergy canvassed proven vendors of SSLNG technology; identified the economics of SSLNG associated with Kudu gas vs liquid fuels; and identified the potential for extracting LPG from Kudu gas as well as its potential market within Namibia.

- Small Scale LNG (& LPG) Market Study – MJMEnergy identified the potential market for gas to be delivered in the form of trucked or railroad transported LNG in Namibia, Western Cape or other bordering countries.

Small Scale Liquefaction and LNG (& LPG) transport technical and cost survey – This involved canvassing the most relevant/proven vendors for each category of equipment or plant, as well as existing small-scale LNG liquefaction and transport operations from all over the world (including the US, Europe, China and India), to identify & screen solutions, equipment, and costs.

Small Scale Liquefaction and LNG (& LPG) transport economics –This involved canvassing the most relevant/proven vendors for each category of equipment or plant, as well as existing small-scale LNG liquefaction and transport operations from all over the world (including the US, Europe, China and India), to identify & screen solutions, equipment, and costs.

LPG economics – MJMEnergy identified potential for extracting LPG/condensate from the gas as part of small-scale liquefaction gas pre-treatment process and assess LPG market in Namibia and incremental economic benefit of such extraction.

Project Conclusions

In light of the research and analysis undertaken by MJMEnergy Ltd, the following conclusions were drawn:

- There is a potential market for SSLNG – The results of our analysis indicated that there could be a viable market for SSLNG of at least 0.1mtpa, in Namibia and the surrounding regions.

- The costs are not prohibitive – The costs of liquefaction, transport, storage and regasification, while higher that some industry commenters suggest, are still low enough to make the use of SSLNG in power, cement and trucking viable.

- LNG fuelled transport – This was the biggest surprise, with potential demand higher than we had initially expected. This is due to a variety of factors including the large size of the country, the high-quality roads, the dependence on road transport and the recognition by haulers of the opportunity to gain commercial advantage through the use of SSLNG.

Background

Indonesia faces the challenge of a combination of high energy demand growth, reinforced by a political will to expand natural gas’ share of energy use. This is against a background of several additional issues as follows:

- Declining indigenous production

- Increasing dependence on energy imports including LNG

- A poorly interconnected gas network and virtually no city-gas infrastructure

- Widely scattered central and eastern islands with relatively small markets and unserved by any gas supply, with the sector dominated by large SOE’s (State-Owned Enterprises).

However, SSLNG (Small Scale LNG) in the form of small liquefaction plants have been shown to be a cost-effective method of producing and distributing small volumes of LNG in multiple locations globally. In addition, in numerous island locations LNG ISO container shipping has been proven to be the lowest cost and most operationally flexible solution for supplying LNG to small markets. Therefore, in the light of the energy challenges that an archipelago nation like Indonesia faces, SSLNG can be part of the solution. In particular, SSLNG liquefaction, combined with transportation by ship, rail & truck, could deliver gas from stranded gas fields, and flared gas, to potential gas customers off-grid or in remote locations.

In the light of this information, the IFC, in collaboration with the World Bank, asked MJMEnergy to assist in promoting the development of SSLNG in Indonesia. through several activities including:

- Exploring potential SSLNG liquefaction using flared and stranded gas as feed

- Identifying potential markets for SSLNG

- Identification of optimum SSLNG production & transport technologies, costs and potential

- suppliers as applicable within the Indonesian context

- Exploration of regulatory & fiscal obstacles to the development of SSLNG in Indonesia

- The dampening effect of SOE dominance on investment in the sector; an

- The identification of specific potential SSLNG liquefaction project concepts with their respective off-takers and sponsors.

Brief Overview of Project

In particular MJMEnergy focused on the following areas in relation to SSLNG:

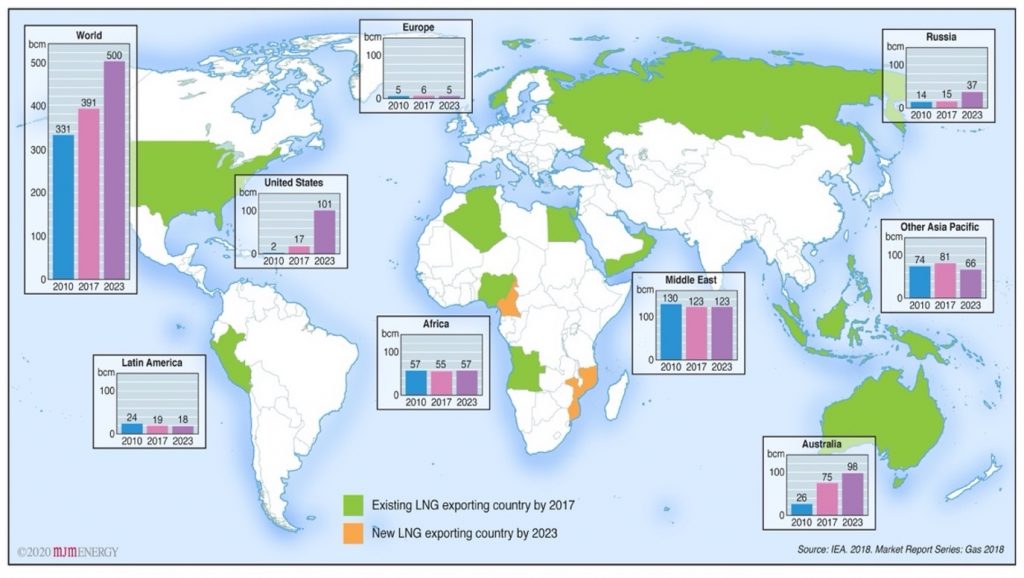

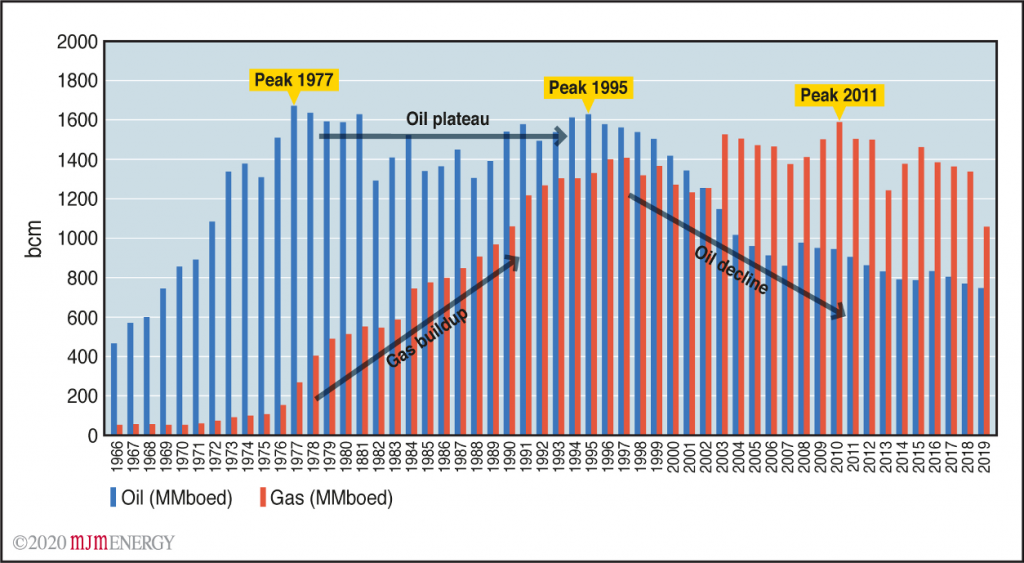

LNG Market Overview – MJMEnergy provided a review of LNG supply, demand and pricing together with a discussion of Indonesian gas supply/demand balance, how the current LNG supply surplus (and demand decline during the first 6 months of 2020) has affected pricing and how this will likely play out in the future. This review of the market was intended to provide a context for the development of SSLNG projects throughout the world and in particular Indonesia.

Potential markets for SSLNG in Indonesia – MJMEnergy identified potential SSLNG market opportunities in Indonesia, estimated the potential size of the SSLNG market in Indonesia, and provided examples of how to incentivise SSLNG sellers and buyers.

An introduction to LNG and SSLNG and SSLNG Technologies – The Project Team provided a brief introduction to both LSLNG (Large Scale LNG) and the development of SSLNG across the world. Areas in Indonesia where SSLNG could supply gas to off-grid customers from sources of gas that might not otherwise be developed using unconventional storage and delivery solutions were highlighted. MJMEnergy also explored the key technologies associated with the development of SSLNG.

Estimating the potential size of the Indonesian SSLNG market – MJMEnergy provided an indication of the scale and types of opportunities where SSLNG might be most suitable within Indonesia.

Overview of the business development approach – MJMEnergy explored the business development framework and environment in Indonesia for SSLNG. The Project Team focused upstream on the availability of gas for SSLNG liquefaction by examining the potential sources of gas including LSLNG, MSLNG, imported LNG, stranded gas fields, and flared gas; and for the midstream, focusing on the structural issues that have constrained the country in the past from developing a viable SSLNG and MSLNG distribution network.

SSLNG Case Studies – MJMEnergy provided a number of fictitious scenarios that were developed to facilitate the readers understanding of SSLNG projects.

The regulatory framework – MJMEnergy explored the current, and where possible future, planned regulatory framework for the energy market by initially describing the chequered history of regulations in Indonesia in encouraging domestic take up of gas. An overview

of the key regulatory areas that affect SSLNG, including important recent regulatory changes, looking at key statutory issues pertinent to SSLNG, and examining the impact of SOE’s was provided.

Project implementation and conclusions

In order to undertake this work for MJMEnergy formed a bespoke Project Team made up from a combination of MJMEnergy internal staff, international associates and local partners in Indonesia.

The Project Team were able to make a case for the status of the potential opportunity available to Indonesia beginning mid-2020 resulting from the combination of abundant gas and LNG supply, low gas and LNG prices, falling SSLNG infrastructure costs and encouraging messages from Government about the strategic need for the country to transition to gas as a domestic fuel rather than just an earner of export revenue.