- Review, development and negotiation of GSA’s and SPA’s.

- Review and development of gas purchasing negotiation strategies.

- Development of Network Codes

- Development and negotiation of LNG TUA’s (Terminal User Agreements).

- Participation in expert witness cases involving energy contracts.

Case Studies

Background

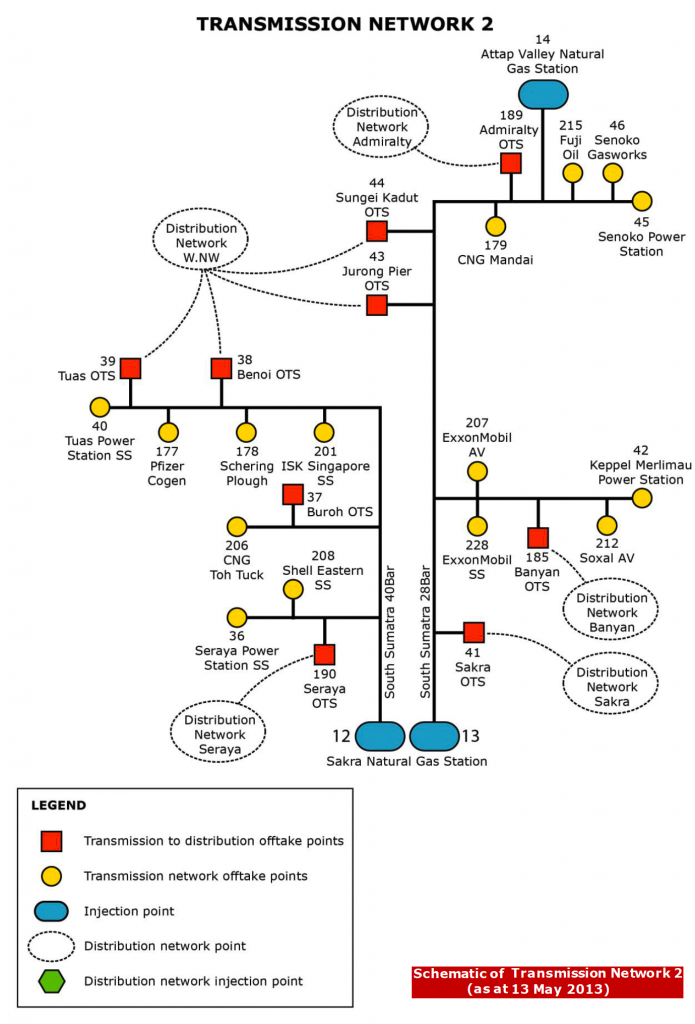

The Singapore gas market was restructured to provide a competitive gas industry framework in order to support the liberalisation of the electricity industry, as natural gas had become the main fuel for power generation, accounting for about 80% of total electricity generated in Singapore. As part of restructuring, the gas transport business was separated from the competitive business of gas import and retail. In order to provide open and non-discriminatory access to the gas pipeline network, the Gas Network Code (GNC) set out the common terms and conditions between the gas transporter and parties that engage the gas transporter to transport natural gas through the pipeline network, also known as shippers. Within this GNC was the provision to establish the Gas Market

Surveillance Panel (GMSP) to ensure that the gas market functions effectively and efficiently. The GMSP comprising three independent experts was formed

The Energy Market Authority (EMA) therefore sought to hire a Consulting Firm to assist the GMSP in its conduct of the investigative and monitoring activities in order to achieve its main objectives as follows:

- Identify inappropriate or anomalous market conduct, including the misuse of market power, gaming, collusion and conduct which may have an adverse effect on the safe, efficient, reliable and economic operation of the gas pipeline network;

- Identify breaches of the GNC; and

- Recommend remedial and other actions to mitigate the inappropriate conduct and breaches

Project Overview

From July 2010 to October 2013, MJMEnergy were appointed by the Energy Market Authority (EMA) of Singapore to provide consultancy services to the Singapore GMSP. As retained consultants to the GMSP, in consultation with the Singapore gas industry, MJMEnergy developed a series of market indices to determine the health of the Singapore gas market. 12 quarterly reports were then produced and presented to the GMSP and the regulator which assessed market performance against the indices over the period Q2 2010 to Q1 2013. In this context, MJMEnergy made recommendations for reforms to the Singapore Gas Network Code. Redacted versions were also produced with confidential information removed for wider publication.

MJMEnergy staff provided all the substantive work on this project which included the following:

- Meeting the regulator and the GMSP

- The formulation of key indices and the development of an evaluation framework for identifying anti-competitive behaviour

- Writing consultation reports and responding to industry comments

- Working with the gas transporter to extract energy market data for market monitoring

- Calculating the indices using a combination of SQL and Excel, producing quarterly market monitoring reports and presenting these to the GMSP and the industry

Conclusions

MJMEnergy’s Market Monitoring Report (MMR) for Q4 2012 analysed the performance indices and reviewed the operation of the Singapore gas market. MJMEnergy found that, in general, the market and the GNC appeared to be working well and there were no immediate and significant concerns of anti-competitive activity or breaches of the GNC. However, there were a number of areas where further investigation was recommended. A selection of these areas included:

- Capacity provisions by the Transporter

- Capacity utilisation by shippers

- Nominations and Flows by shippers

- Scheduling

- System security and risks

Background

With gas demand rising in Pakistan and indigenous gas supplies in decline, Pakistan has developed and built two new LNG import terminals with more LNG import terminals planned for the future. However, under the initial arrangements these LNG import terminals have been dominated by single users supplying RLNG to either incumbent monopolies or large power generators. As a result these existing arrangements impeded access to gas supplies for new market entrants in Pakistan’s developing competitive gas market.

Project Overview

Therefore the objective of this assignment was for MJMEnergy to provide support to key gas sector stakeholders in Pakistan in advancing the regulatory framework for non-discriminatory third-party access in Pakistan’s LNG import terminal infrastructure. In particular, MJMEnergy worked with the Government of Pakistan and it’s oil and gas regulator OGRA to promote competition, strengthen, transparency, create a level playing field, and encourage new investment in an increasingly market-oriented gas sector in Pakistan by developing open transparent TUAs (Terminal User Agreements) .

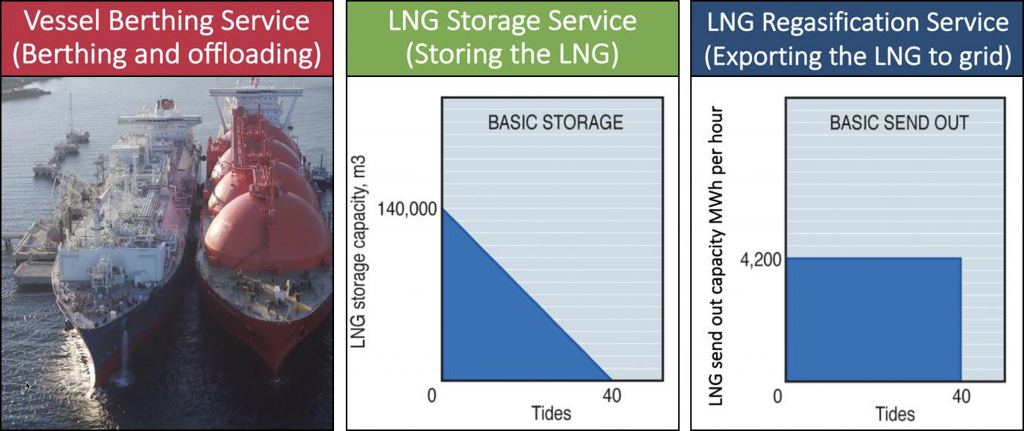

Work undertaken during this project – In many respects the provision of technical advice for the project required the MJMEnergy Project Team to provide a combination of consultancy and capacity building. The following diagram is an example of a diagram from paper presented to OGRA the oil and gas regulator on the different services provided by an LNG terminal.

Over a period of some the MJMEnergy Project Team were able to develop and present a series of papers relevant to the development of LNG TPA TUAs, covering the following areas:

Over a period of some the MJMEnergy Project Team were able to develop and present a series of papers relevant to the development of LNG TPA TUAs, covering the following areas:- Defining LNG import terminal services.

- LNG import terminal capacity allocation.

- The Annual Delivery Programme.

- Borrowing and Lending.

- Capacity management

- LNG TPA Rules.

- Relevant license documents

- LNG TPA Code

Conclusions

Background

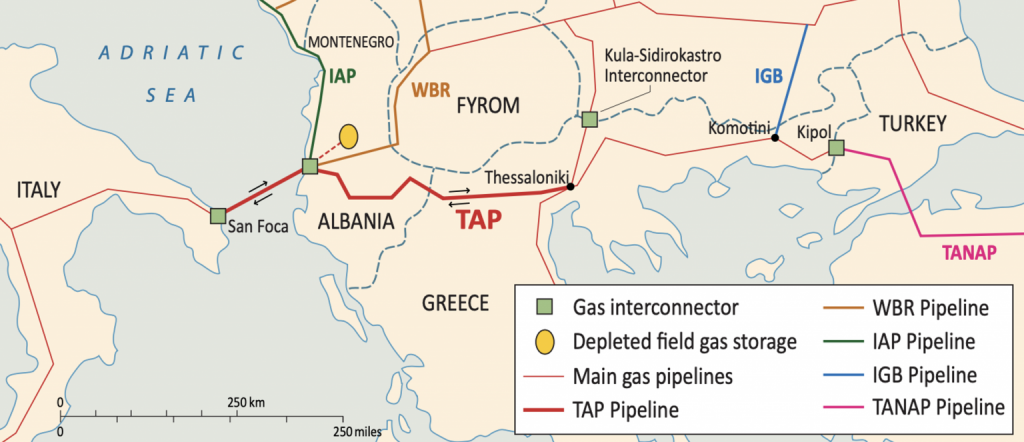

In order to qualify for supplies from TAP, Albania has adopted the Energy Community Treaty and made legally binding commitments to adopt and implement core EU energy legislation including the Energy Community Treaty, the Energy Charter Treaty and the Third Energy Package (“TEP”).

Project Overview

Therefore, as part of a wider capacity building project the MJMEnergy Project Team were required to provide advice and support to Albgaz in the development of a network code contractual framework. This required activity in the following areas;

A review of the TAP contractual regime – At the commencement of this project the MJMEnergy Project Team were required to undertake a contractual review of the TAP Network Code, with a particular focus on identifying potential interactions between the TAP Network Code and systems and processes potentially operated by Albgaz as the TSO/DSO for the national Albanian gas network (i.e. as an Adjacent TSO). In addition to undertaking a review of the TAP draft Gas Network Code the Project Team also provided support to Albgaz in developing its formal response to TAP.

The development of the Albanian Gas Network Code – This was achieved by the Project Team working steadily and systematically with the Albgaz team to explain and refine each section of the Code to work within the context of the potentially developing Albanian gas network. Not only were the Project Team developing a Code for Albania they were also building capacity in Albgaz.

General capacity building for Albgaz the new TSO for Albania – In addition to providing consultancy support and capacity building throughout the project, the Project Team also provided a series of capacity building workshops covering a variety of subjects including energy balancing, nominations, capacity trading and energy trading. In particular the Project Team developed a series of short papers on key areas of the contractual framework. The following diagram is an example taken from the short paper on energy balancing.

- Nominations and scheduling

- Capacity booking

- Capacity management.

- Energy balancing

- Transportation charges

Project Implementation

This project was led by ECA (UK-based economic consultancy) and was funded by the EBRD, with MJMEnergy providing the technical and commercial expertise in relation to gas pipelines, gas networks and associated Gas Network Codes.